Furniture depreciation percentage

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. There are many variables which can affect an items life expectancy that should be taken into consideration.

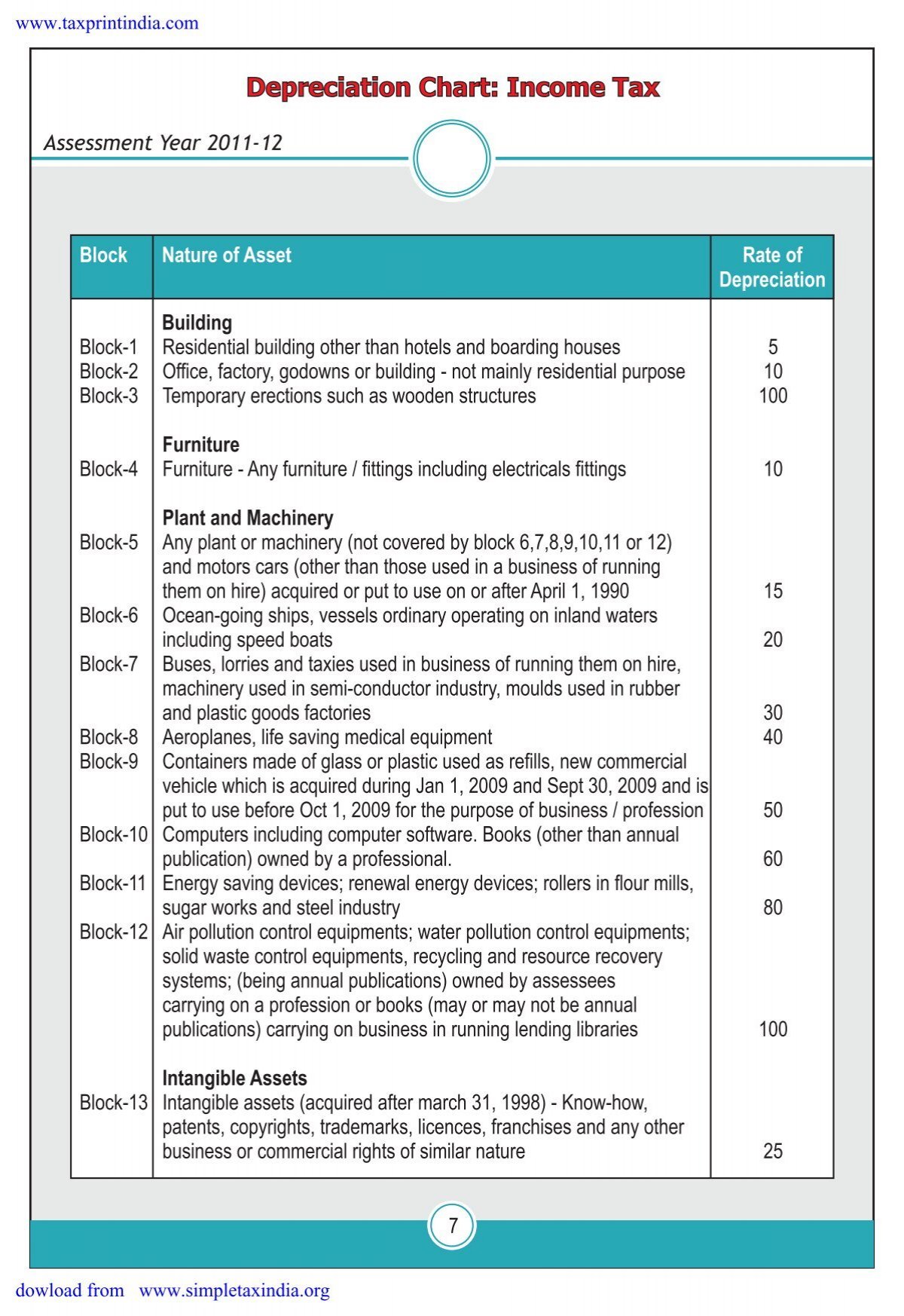

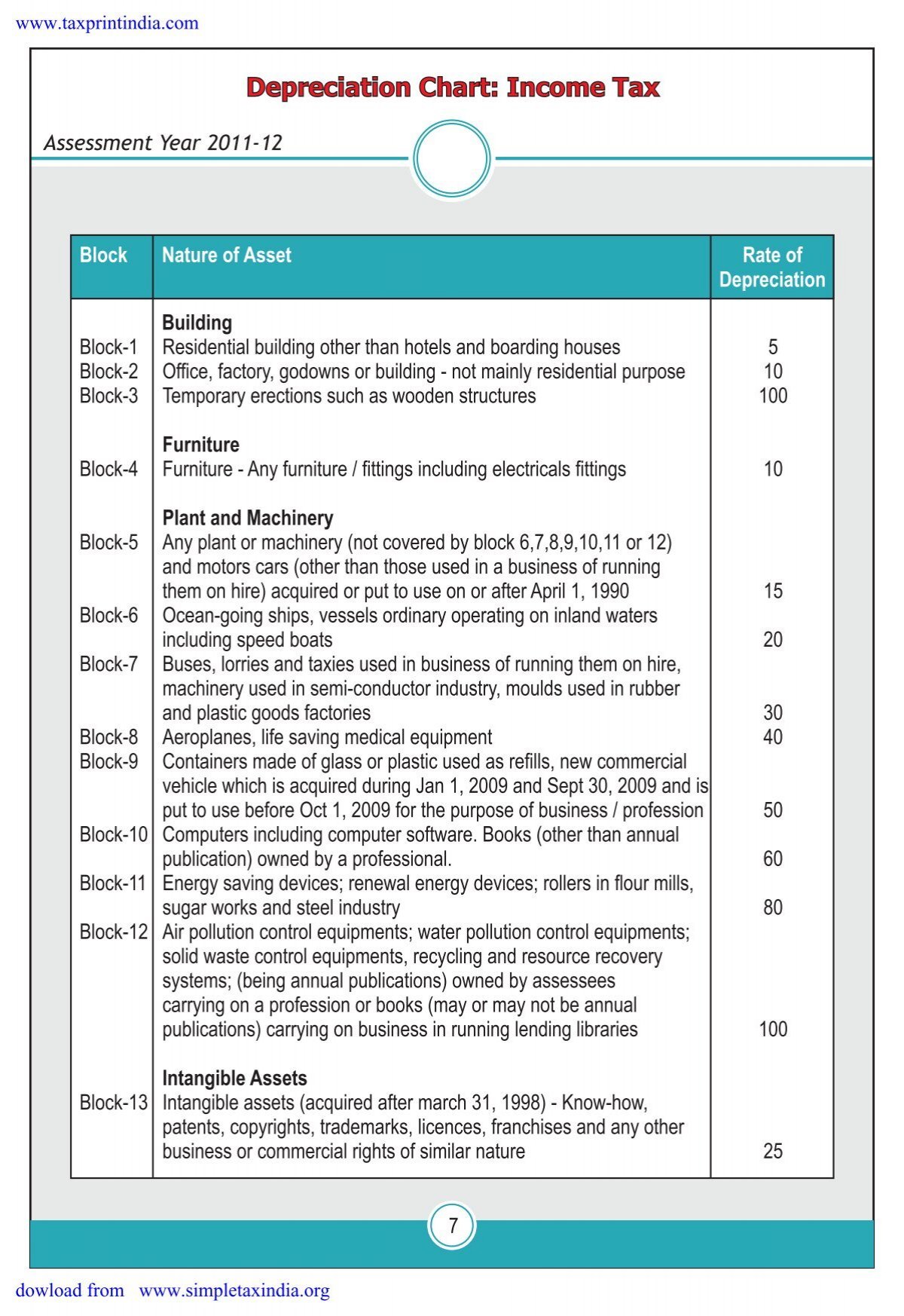

Depreciation Chart Income Tax

Then plug this number.

. This allows for 75 percent of the first. Section 179 deduction dollar limits. And if you bought a dining room set.

You need to know the full title Guide to depreciating assets 2022 of the publication to use this service. Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5. In this case he could.

5 4 3 2 1 14. To calculate depreciation using this method you start by adding the sum of all the years of useful life. The calculator should be used as a general guide only.

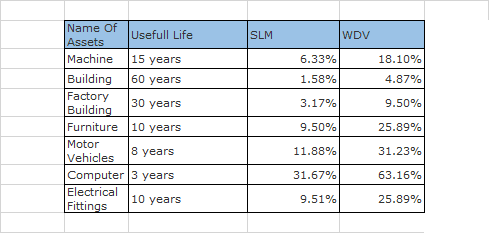

For non-accountants calculating your office furniture depreciation can be confusing. So some businesses opt to do it the simplest way. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

It takes the straight line declining balance or sum of the year digits method. For example if you have an asset. For 5 years this looks like this.

A usual practice is to apply a. Additionally you can deduct all of the business part of your expenses for maintenance insurance and utilities because the total 800 is less than the 1000 deduction limit. Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam.

However he can use the same percentages as determined by the assessor and apply them to the original purchase price to determine how much can be depreciated. In this example if the furniture is put into service for a business during the first applicable tax year the half-year convention is applied. On average furniture depreciates by about 20 per year.

If you are using the double declining. You know how much your furniture cost you but how much is it worth now. Use our automated self-help publications ordering service at any time.

By dividing the furnitures. This limit is reduced by the amount by which the cost of. The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used.

The following calculator is for depreciation calculation in accounting. So if you paid 1000 for a couch five years ago it would now be worth only 400. 170 rows Class of assets.

When it comes to determining depreciation for Furniture Fixtures and Equipment FFE there are many considerations that exist for accountants and business owners. 59 rows Furniture used by children freestanding. Percentage Declining Balance Depreciation Calculator.

Depreciation Rates For Asset Types In France Helmer Et Al 2016 Download Scientific Diagram

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Rate For Plant Furniture And Machinery

Depreciation Calculator For Companies Act 2013 Taxaj

![]()

Furniture Calculator Splitwise

Depreciation Formula Calculate Depreciation Expense

Furniture Depreciation Calculator Calculator Academy

Depreciation Rate Formula Examples How To Calculate

Manufacturing Special Tools Depreciation Calculation Depreciation Guru

Cost Analysis Of Furniture Parts Production Download Table

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Of Furniture And Fixtures Download Scientific Diagram

How To Calculate Depreciation Expense For Business

An Update On Depreciation Rates For The Canadian Productivity Accounts

Accumulated Depreciation Explained Bench Accounting