401k calculator with over 50 catch up

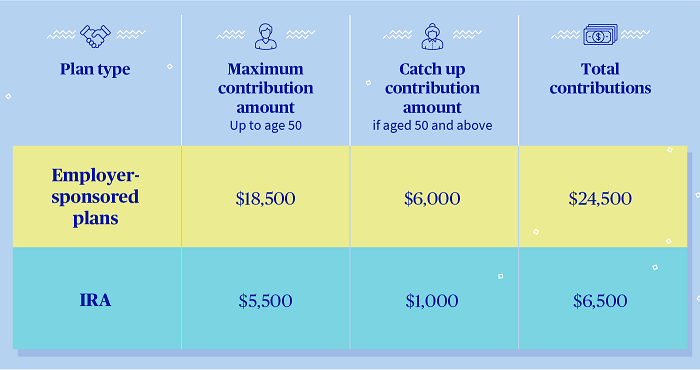

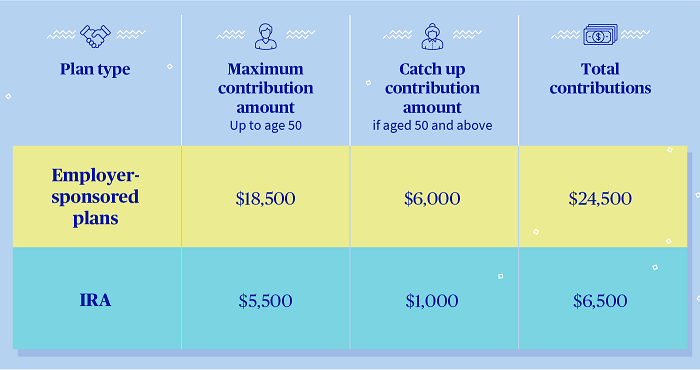

If you are 50 years of age or older and are already contributing the. For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500.

How Much Should I Have In My 401 K At 50

My husband turned 50 in 2018.

. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up. This means that if you are 50 or over you can contribute a total of 27000 per year. The catch-up contribution limit is 6500 in 2022 for people age 50 or older.

If you want to know how much you can put aside for. Get to your destination by making sure your retirement tank is full. The maximum you can contribute to a 401 k is 20500 in 2022.

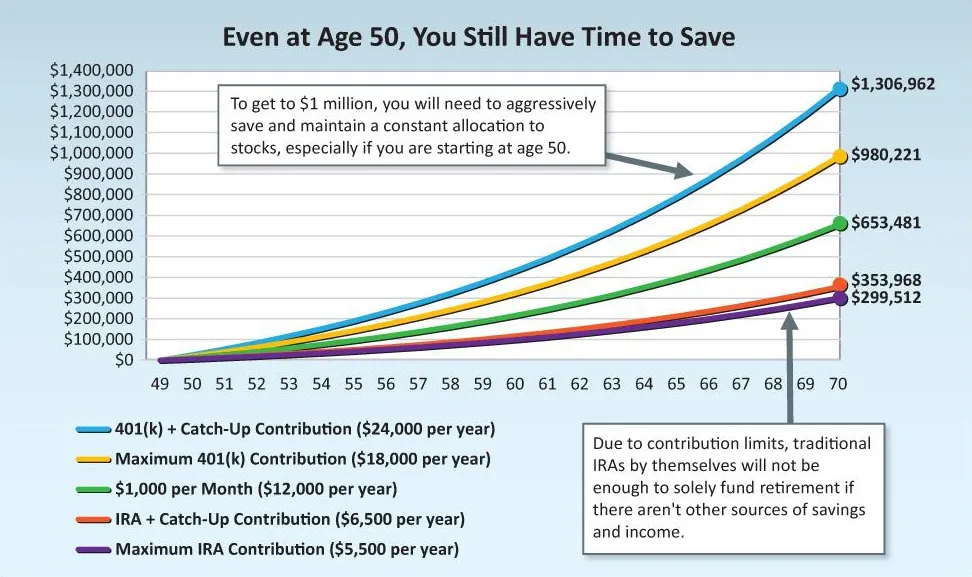

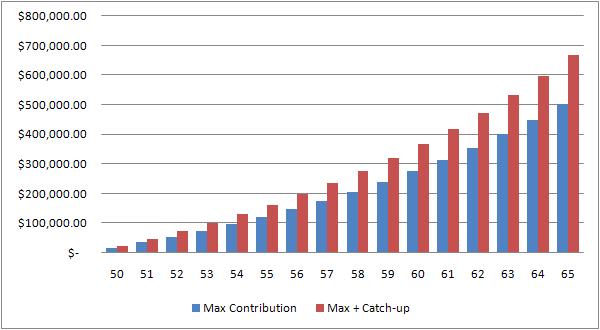

Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. Account values for the next 20 years. It provides you with two important advantages.

However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. Those turning 50 or older can put a. Catch-up contributions can help you do just that.

For those age 50 and older the 401 k catch-up contribution is 6500. If you are age 50 or over a catch-up provision allows you to. According to the IRS he can contribute 6000 for 401k catch up.

The Internal Revenue Service allows individuals who are age 50 or older by the end of the calendar year to make extra pre-tax contributions to their work-sponsored retirement. The TurboTax software is saying he contributed over the 18500 but it is less than the 6000. A 401 k can be one of your best tools for creating a secure retirement.

According to the IRS he can contribute 6000 for 401k catch. First all contributions and earnings to your 401 k are tax deferred. The annual elective deferral limit for a 401k plan in 2022 is 20500.

Participants who are 49 and younger may save 20500 but those over 50 are allowed an additional catch up contribution of 6500. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

If youre 50 or older and need to catch up on your 401 k retirement savings the total amount youre able. First all contributions and earnings to your 401 k are tax deferred. Therefore participants in 401k 403b most 457 plans and the federal governments Thrift Savings Plan who are 50 and older can contribute up to 27000 starting in.

In 2022 the maximum annual 401 k contribution limit for those age 50 or older was 27000. A participant who is eligible to make catch-up contribution is referred to as catch-up eligible participant A participant is catch-up eligible with respect to a plan year if he or she. Annual catch-up contributions up to 6500 in 2022 6500 in 2021.

Of this 20500 is the standard contribution limit that applies to everyone and. The 401k plan annual contribution limit is 20500 while the catch up contribution is 6500. Catch-up contributions can help you do just that.

Advice And Tips On Saving For Retirement At Any Age Marketplace Org Money Saving Tips Budgeting Money Money Management

Here S How Catch Up Contributions Can Grow Your 401 K Over Time

Here S How Catch Up Contributions Can Grow Your 401 K Over Time

How To Take Advantage Of 401 K Catch Up Contributions Wtop News

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Make The Most Of Your Employer S 401 K Match Wealthtender

With Age Comes Great Responsibilities And At The Top Of Your List Should Be Taking Charge Of Your Money Www Levo Com Finance Personal Finance Budgeting Money

Best Retirement Calculator Retirement Calculator Retirement Income Saving For Retirement

Retirement You Can Save 1 Million Even Starting At Age 50 Money

401k Catch Up Contributions Retirement Catch Up Limits

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

Resources To Help You Manage Your 401k Independent 401k Advisors

How To Play Catch Up With Your Retirement Savings Barron S

How To Catch Up In Your Retirement Savings Plans Equitable

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

Simple Retirement Savings Calculator Easy To Use Retirement Savings Calculator Savings Calculator Saving For Retirement

401k Calculator